Subordination

Monetary Subordination in the Eurozone: Core-Periphery through Money, Finance, and Subordinate Integration

PhD Thesis under the supervision of professor Costas Lapavitsas at SOAS university of London

The consequences of structural subordination in the process of European financial and monetary integration for Italy

Abstract

The presence of Subordination --whose principle is at the heart of Core-Periphery Structure-- in the European Monetary Union appears evident in general terms --such as the persistent yield spreads or productivity, but elusive in terms of the specific forms of Subordination.

This work offers methodological and conceptual elaborations on subordination and specifically monetary subordination applied to the EMU.

Being developed whilst the International Financial Subordination literature at large was consolidating into a fully-fledged area of research, this work is primarily concerned with monetary subordination, which is understood to be the the vertex of subordination, and especially formalised in a monetary union due to the shared money. Subordination for a monetary union should be based on the peculiarity of such a system: it is an extreme form of monetary integration and unification, which brings forth at the same time more clearly the appearance of subordination and more subtly its actual features.

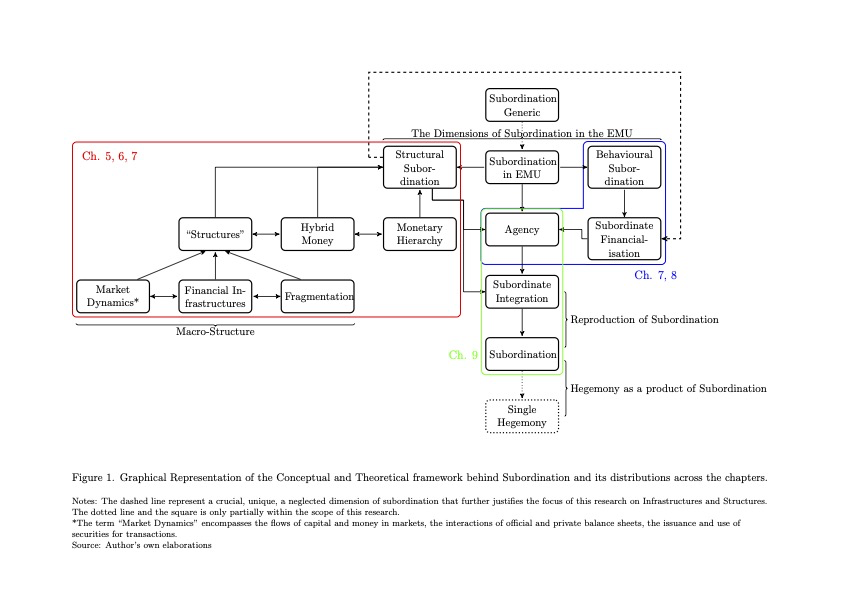

The main analytical chapters of this work argue that there are three pillars of monetary subordination in the EMU: the monetary hierarchies,[1] the hybrid money,[2] and the selective fragmentation and integration at play in the Eurozone.

These are studied in terms of their appearance as well as of the mechanisms that support their existence and how they contribute to monetary subordination, offering detailed empirical support for the arguments via unused official datasets, graphical representations, and balance sheet analysis.

The consequences of monetary subordination are then explored, specifically by looking at a historical case study --Italy[3]-- and at a comparative analysis of Financialisation in six key Eurozone member states.

It is shown that for Italy, the creation of the single and common currency reframed monetary and financial subordination shifting the "centre" from the USD-based international system to a Euro-centric form of subordination, which has significant consequences on the economic development of the domestic economy. Missing from the current approaches, the "subordination lens" offered here is needed for a complete understanding of the economic and financial fragility experienced by Italy.

As for financialisation, the presence of monetary and financial subordination allows for the use of "subordinate financialisation" approach to look comparatively at key Eurozone countries to show that subordinated countries in the EMU behave similarly to subordinated EMEs, namely their financialisation is shaped by their position.

Ultimately, the empirical analysis and theoretical framework offered seek not only to shed light on the hierarchical nature of the Eurozone, but also to spur further research on the role of money and monetary infrastructures for Subordination and on the internal asymmetries of monetary unions via the conceptual approach developed.

for analyses of the different dimensions of the monetary hierarchies in the Eurozone, see Murau and Giordano (2024) and Giordano (2024b) ↩︎

see Giordano (2024d) ↩︎

see Giordano (2024c) ↩︎